Table Of Content

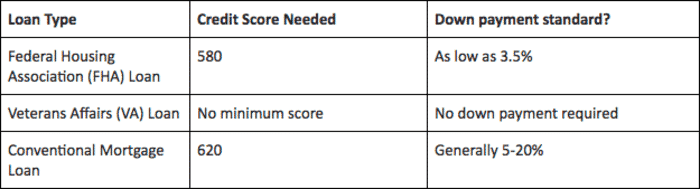

The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you're applying for and your lender. While it's possible to get a mortgage with bad credit, you typically need good or exceptional credit to qualify for the best terms. If your score is below 620, lenders either won’t be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly mortgage payments. If you have bad credit, you may want to work on improving your score before applying for a conventional mortgage loan. A good credit score to buy a house is one that helps you secure the best mortgage rate and loan terms for the mortgage you’re applying for. You’ll typically need a credit score of 620 to finance a home purchase.

Other factors to consider when applying for a mortgage

And your household income can’t be more than 115% of the area’s median household income. These are the five states with the lowest average credit scores among Credit Karma mortgage-holders. Here are the top five states with the highest average credit scores among Credit Karma mortgage-holders.

First, let’s talk about credit scores.

Aiming to get your credit score in the "Good" range (670 to 739) would be a great start towards qualifying for a mortgage. But if you're wanting to qualify for the lowest rates, try to get your score at least within the "Very Good" range (740 to 799). If you have a strong credit score, you'll have a better chance of securing a good mortgage rate. Mortgage lenders pull a different set of scores to paint a more reliable picture of your borrowing habits. This is a credit report that only lenders can run, and most will do it free of charge to earn your business.

Check Your Credit Score and Reports

While many lenders still prefer credit scores of at least 620, there are likely lenders that will accept borrowers with lower scores. Conventional mortgages are home loans that follow the standards set by Fannie Mae and Freddie Mac. They typically offer competitive interest rates and flexible mortgage repayment terms that range from 8 to 30 years. Conventional loan financing is typically best for borrowers with good or excellent credit because they require a higher credit score than government-backed loans. Your credit scores are an important factor that lenders will use when evaluating your mortgage application. Because there are several types of home loans, there’s not necessarily one specific credit score requirement you’ll have to meet.

As an online lender, Zillow allows much of the loan application process to be completed via your computer or mobile device. The good news is Zillow Home Loans will assign you a dedicated loan officer to guide you and your real estate agent through the home loan process. This person will be your primary point of contact, from loan application until closing. Only residents of the state of New York are ineligible to take out a mortgage loan from the online lender at this time.

FHA loans

Depending on your home financing needs, Zillow Home Loans could be a decent choice for a mortgage lender. Yet it’s always wise to look at offers from several lenders before you commit to a specific lender. According to Fannie Mae, comparison shopping could save you thousands of dollars on a home loan. When you apply for a mortgage with Zillow Home Loan, the online lender will require you to meet certain criteria to qualify for financing. The exact requirements you need to satisfy may vary depending on the specific loan program. Below is a general idea of some of Zillow Home Loans’ minimum borrower requirements.

For a conventional mortgage, a modest credit score of 620 is typically sufficient, with just a 3% down payment. The credit score needed to buy a house varies depending on the type of loan and the lender’s requirements. The U.S. Department of Agriculture offers USDA home loans to promote rural development. To qualify for this type of mortgage, you must purchase a single-family residence in an eligible rural location.

When you buy a home, lenders want to know you’ll have a source of reliable income to make your loan payments. Lenders prefer that you have at least two years of employment income, though they can approve someone with just one year of employment if they have reason to believe your income is stable. Also keep in mind that adding new credit can increase your DTI, which is a crucial factor for mortgage lenders. This will include details like your loan amount, monthly payment, interest rate and a list of closing costs. It’s important to shop around and compare your options with as many mortgage lenders as possible to find a good deal. Many lenders let you get pre-qualified with only a soft credit check that won’t hurt your credit.

Faster, easier mortgage lending

What credit score do you need to buy a house? - SFGATE

What credit score do you need to buy a house?.

Posted: Thu, 14 Sep 2023 07:00:00 GMT [source]

However, some lenders may offer mortgage loans to borrowers with scores as low as 500. All things considered, almost all of the neighborhoods listed in this ranking have an average credit score at or above 670, which is considered "good" by lenders. It’s also worth noting that the minimum credit score requirements from Zillow Home Loans are a bit stricter than what some other lenders may require. You need at least a 620 FICO Score to qualify for most loans from the online lender.

There are about 16 versions or models of the FICO score, all of which are based on a statistical analysis of your credit profile. For mortgages, lenders usually rely on FICO credit scoring models 2, 4 or 5. VA loans backed by the Department of Veterans Affairs are designed to help veterans, current servicemembers and eligible surviving spouses access better terms on home loans. For example, VA loans don’t require a down payment or mortgage insurance. The first step to improving your score is finding out where you stand. You can currently check your credit report for free once every week with all three major credit bureaus (TransUnion, Equifax, and Experian) at AnnualCreditReport.com.

The lower your DTI, the better chance you have at being offered a lower interest rate.

Among this set, the average VantageScore 3.0 credit score is 705 and the median is 725. Users had an average mortgage balance of $231,194, with an average next monthly payment of $1,632. Your credit score plays a major role in your ability to secure a mortgage loan.

How To Get A Home Equity Loan With Bad Credit - Bankrate.com

How To Get A Home Equity Loan With Bad Credit.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

When the loan is paid off (or you reach a certain threshold), the lender gives you access to the funds. And you may find that some lenders have a different tolerance for debt ratios. Your credit scores are important, but they’re not the only factor that lenders consider when you apply for a mortgage.

If your credit score is above 580, you’re in the realm of mortgage eligibility and homeownership. With a score above 620, you should have no problem getting credit-approved to buy a house. Consistent employment in the same field or with the same employer over several years indicates job stability, which lenders favor. This section of your application helps lenders feel confident in your ongoing ability to meet mortgage payments. Stable income and assets are key components in the home-buying process.

No comments:

Post a Comment